Think of an EIN as a social security number but for your business. It is a 9-digit identification number and all businesses in the US need to have an EIN before they can begin operations. The Internal Revenue Service (IRS) issues Employer Identification Numbers or EINs to businesses to help identify them. EINs help businesses stay compliant with tax laws, hire employees, and verify their identity to their clientele.

Let’s understand the meaning, purpose, use, and more of EIN for businesses.

What is EIN?

An EIN is a 9-digit identification number that is issued to businesses by the IRS. The format for an EIN is XX-XXXXXXX. Employers, partnerships, non-profit organizations, sole proprietorships, corporations, and other entities that hire employees use EINs.

While EINs help businesses with tax law compliance, they are not the same as Tax Identification Numbers or TINs. TIN is a basket term used to identify any taxpayer in the US, so your Social Security Number can also be considered a TIN. A business or any other entity that is obligated to have one can only have one EIN. It is suggested that you mention your business’ EIN every time you send any item to the IRS or the Social Security Administration (SSA).

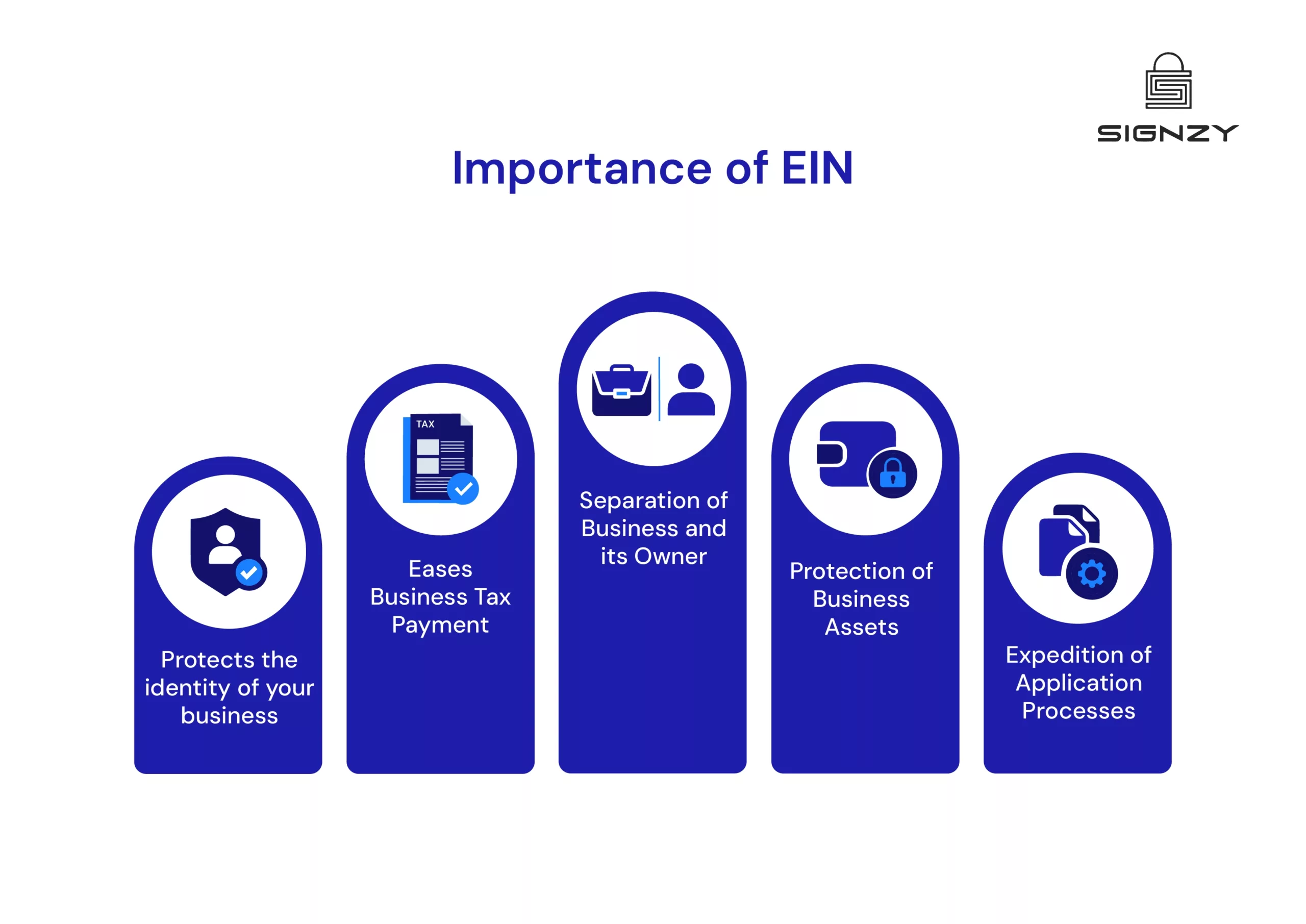

Importance of EIN

Obtaining an EIN for your business has the following advantages:

- Protects the identity of your business: An EIN helps add a layer of security to your business’ identity. Since EIN can be used instead of other tax identification numbers, it is a good way to avoid sharing your SSN.

- Eases Business Tax Payment: Since EINs are related especially to business tax payments, they help businesses in staying compliant with tax laws. This is especially useful for smaller businesses that often use their personal accounts to make payments, which are difficult to track.

- Separation of Business and its Owner: An EIN gives your business a separate identity that is not linked to your personal identification. This helps keep your business accounts separate from your personal accounts and can help protect the finances of both legal entities.

- Protection of Business Assets: While you do not plan for your business to go bankrupt, in the unfortunate event that your business does go under, an EIN can help protect your personal assets from your business’ losses.

- Ease in Acquiring Loans, Licenses, and Expedition of Application Processes: An EIN provides your business with a unique identifier that helps distinguish it from yourself and other peer businesses. This layer of separation helps in the faster identification of your business and expedites the process of loan disbursement, licensing, and other regulatory processes.

Who needs EIN?

According to the IRS, if your business meets any of the following conditions, you need to get an EIN if:

- You have hired any employees.

- You operate a business as a corporation or a partnership.

- You have a business that files Employment, Excise, or Alcohol, Tobacco and Firearms Tax Return.

- Your business withholds taxes on income paid to a non-resident alien, other than wages.

- Your business has a Keogh plan.

- You are involved with organizations like Trusts (except certain grantor-owned revocable trusts), IRAs, Exempt Organization Business Income Tax Returns, Estates, Real estate mortgage investment conduits, Non-profit organizations, Farmers’ cooperatives, or Plan administrators.

How to apply for EIN online?

If you want to have an EIN issued for your business, you can do so by sending a mail, or online, with online being the faster and easier way to get the job done. Here are the steps to apply for an EIN using the different methods.

Apply for EIN Online

Follow the steps below, to apply for an EIN online:

- Visit the EIN application website by the IRS.

- Click on the “Apply Online Now” button. The operating hours to apply for an EIN are 7:00 a.m. to 10:00 p.m. (Eastern Time).

- Fill out the interview-style application form.

Upon the completion of the application and validation processes, you will receive your EIN immediately. The EIN confirmation can be downloaded, saved, and printed for your records.

Things to note for the online application process are:

- The form must be filled in a single session. Your progress will not be saved and cannot be resumed later.

- The application session will expire if you are inactive for 15 minutes or more. So, ensure that all the necessary documents and information is close by and accessible.

- A valid SSN, ITIN, or other Taxpayer Identification Number is necessary to apply for an EIN.

Apply for EIN by Mail

If you prefer to maintain tangible records of all your business activities or aren’t too inclined to use digital methods, you can apply for an EIN by mail. Once the application is submitted, it can take around 4 weeks for your EIN to be delivered to you. To apply, all you need to do is fill out the form SS-4 with the necessary information about your business, and send it to one of the following addresses:

- For businesses that have a principal business, office, agency, or legal residence (in the case of an individual) in one of the 50 states or the Districts of Columbia: Attn: EIN Operation Cincinnati, OH 45999, Fax-TIN: 855-641-6935

- If you have no legal residence, principal place of business, principal office, or agency in any state: Attn: EIN International Operation Cincinnati, OH 45999, Fax: 855-215-1627 (within the U.S.), Fax: 304-704-9471 (outside the U.S.)

Verify, Fetch, and Lookup EINs with Signzy

Not only does your business need its own EIN, but you might also need to ensure the validity of the EIN of any entity that your business interacts with. Signzy’s EIN Verification API ensures that all your business’ EIN needs are taken care of promptly, to ensure its smooth operation.

Where government platforms can be slow and unresponsive when it comes to fetching and verifying EIN data, Signzy’s API returns results in 0.9 seconds.

Book a call with us and see how Signzy’s EIN Verification API can streamline your operations.

Conclusion

EINs can act as a layer of protection for your business while helping it remain compliant with the country’s tax laws. It can also streamline your tax payment and credit disbursement processes. Make sure that your business has a valid EIN by visiting the IRS website or with Signzy’s EIN Verification API.

Visit https://www.signzy.com/us/ for more information about us.

Comments on “The Complete EIN Guide: What is Employer Identification Number (EIN)? Does Your Business Need it?”